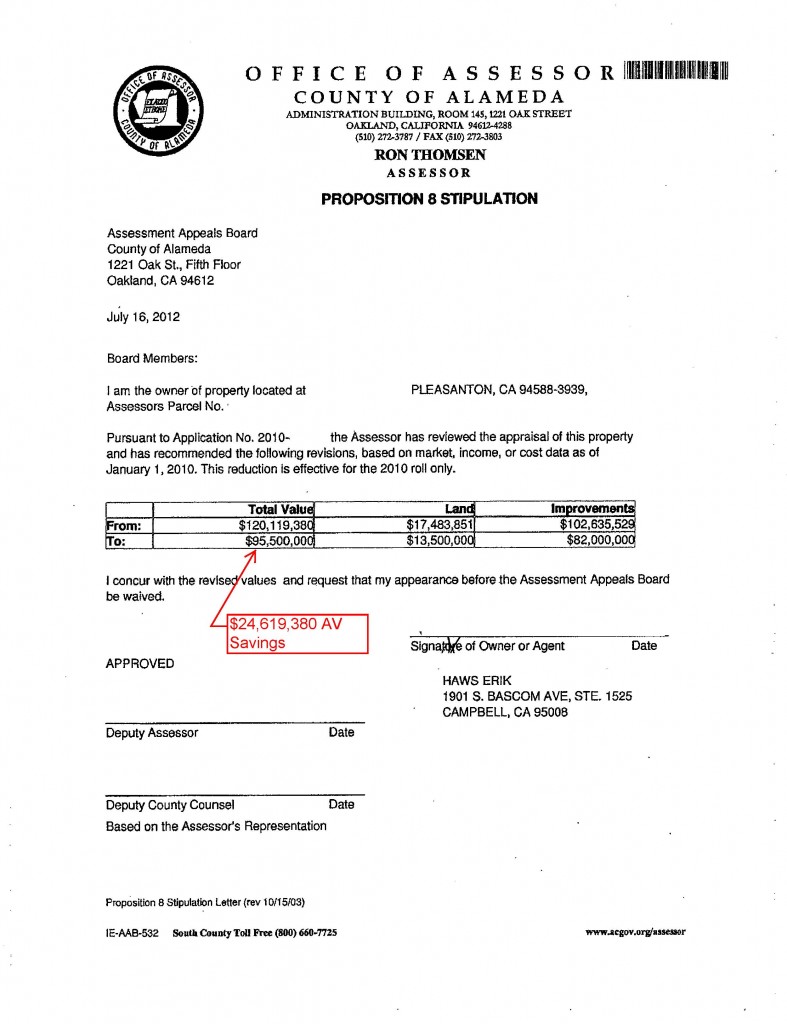

$300,000 Tax Savings!

Here is a California Proposition 8 Real Property value reduction we achieved for our client. This building was way over assessed compared to it’s surrounding like kind buildings. Taking advantage of the California Revenue & Taxation code rules, we were able to deliver a $24,619,380 assessed value reduction. This resulted in a check to the client for almost $300,000 tax dollars BEFORE INTEREST!